Canadian Credit Market Returns to Pre-Pandemic Levels

In Q4 2021, TransUnion’s Credit Industry Indicator increased 32 points year-on-year, driven by higher demand for and supply of credit. Consumers reverted to pre-pandemic credit behaviours as the economy improved, indicating a re-engaged consumer market ripe for growth opportunities. The mortgage market continued to show significant growth with Gen Z consumers driving originations.

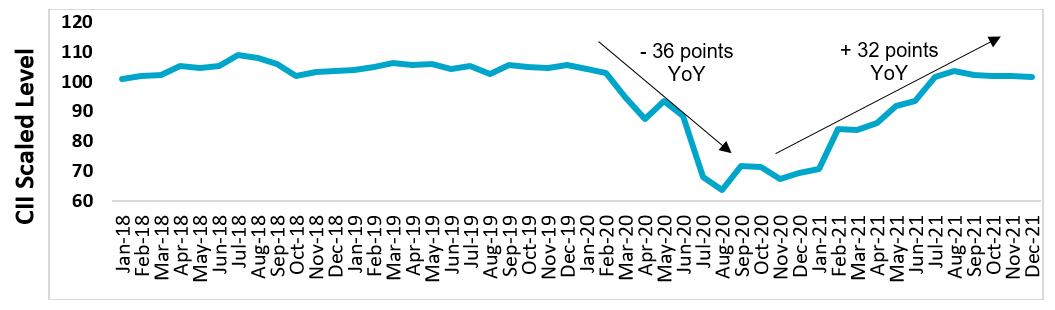

TransUnion today released the findings of its Q4 2021 TransUnion Credit Industry Report (CIIR), which showed signs of a return to pre-pandemic activity in the Canadian credit market. As part of the CIIR, TransUnion maps consumer credit health with its Credit Industry Indicator (CII), which rose 32 points year-on-year (YoY) to 101.6 during the period, driven by ongoing improvements in credit performance, as well as strong demand and supply of credit. While there has been continued momentum as the economy recovers from the pandemic, the CII has not yet returned to pre-pandemic levels; in December 2019, it was at 105.7. The CII, which TransUnion launched in July 2021, is a country-specific measure of consumer credit health trends in four categories: demand, supply, consumer behaviour and performance.

Chart 1: Canadian Credit Industry Indicator

Source: TransUnion Canada consumer credit database.

(i) A lower CII number compared to the prior period represents a decline in credit health, while a higher number reflects an improvement. The CII number needs to be looked at in relation to the previous period(s) and not in isolation. In December 2021, the CII of 101.6 represented an improvement in credit health compared to the same month prior year (December 2020) and a slight decline in credit health compared to the prior month (November 2021).

“As the latest wave of COVID recedes and the economy expands, consumers are reverting to pre-pandemic credit behaviours and lenders are active in seeking growth opportunities,” said Matt Fabian, director of financial services research and consulting at TransUnion. “Lenders have some catching up to do after the pandemic disrupted volumes and balances, and consumer demand is picking up. However, as the market recovers, there are some headwinds on the horizon as the expectation of higher interest rates looms.”

Consumers returned to pre-pandemic credit behaviours

The credit market experienced steady signs of growth in Q4 2021, with a YoY increase of 1.8% in credit participation—the number of consumers with an open credit product—as more consumers opened new products and leveraged existing credit. This growth was driven by above-prime credit score consumers[1], who showed a 4.4% increase in credit participation from the same period last year. Total balance growth across all credit products was up 8.5%, driven primarily by non-revolving products. Balances for non-revolving products grew 3.3%, as mortgage growth continued a positive trajectory (balances up 11%). Additionally, personal loans showed positive momentum with balances up 9%. Revolving balances grew 2% YoY, with credit card balances up 4.2% as higher consumer optimism appears to have driven increased spending and use of credit to finance that spend. Credit card spend rates increased 20% YoY as the economy reopened and consumers returned to pre-pandemic spending patterns.

While credit activity returned to pre-pandemic levels, delinquencies remained low, with no significant signs for concern. Consumer credit card delinquency (the proportion of consumers 90 or more days past due on at least one credit card in wallet) increased by only 2 bps YoY, while personal loan consumer delinquency (the proportion of consumers 60 days past due on at least one installment loan in wallet) increased by 9 bps YoY. This marked the second consecutive quarter for increases in both credit card and personal loan delinquency rates. However, this is a sign of a recovering and growing credit economy as consumers return to pre-pandemic credit behaviours after an extended period of no growth in new credit or outstanding balances for unsecured products.

As the economy recovers, consumers are focusing on saving and reducing debt, with TransUnion’s Q4 2021 Consumer Pulse Survey showing that 74% of respondents felt it was important to have savings for unexpected events, and 20% indicated they are paying down debt at a faster rate.

“Canadian consumers have demonstrated resiliency, with increased savings aided by government and lender assistance programs, and the credit market has remained stable throughout the pandemic,” said Fabian. “Delinquency rates have been lower than expected for several quarters. As the credit market returns to normal activity, with higher levels of account originations and balance growth, and as interest rates rise, which increases the cost of debt, we expect to see a regression back toward pre-pandemic delinquency levels. However, delinquencies are expected to remain at manageable levels over the next several quarters.”

Mortgage growth remained significant, especially among younger consumers

While the mortgage market cooled slightly from its accelerated pace earlier in 2021, in Q3 mortgage originations continued to grow despite high home prices and tight inventory, increasing 5.6% YoY. The increase in originations was led by Gen Z consumers. A small but growing part of the market consisting of mainly first-time homebuyers, this generation increased originations 30% YoY during Q3 2021.

Table 1: Mortgage Originations by Generation

YoY Mortgage Origination Volume | % of Total Origination Market | |

Baby Boomers (born 1946-1964) | -7.1% | 16% |

Gen X (born 1965-1979) | 4.7% | 37% |

Gen Y/Millennials (born 1980-1994) | 10.9% | 43% |

Gen Z (born 1995 – present) | 29.9% | 4% |

“Mortgage lenders are now contemplating interest rate increases, which may raise rates for Canada’s variable-rate holders, and this increased cost of debt may create some additional stress on consumer wallets,” said Fabian. “Based on TransUnion’s previous payment hierarchy research, we do not traditionally see this impacting mortgage delinquency, as consumers prioritize mortgage payments, but other payments like credit cards may see an impact as consumers manage the allocation of disposable income to debt coverage.”

Home prices continued to rise in Q4 2021, fueled by low interest rates as well as low inventory. The average mortgage balance per consumer increased 10% YoY to $320,835. Average new account balances in Q3 2021 increased 19% from the previous year, up to $386,026. Ontario and British Columbia led the way in new mortgage balances, up 22% and 19%, respectively. This was driven by major markets within those provinces, with Toronto’s average new mortgage amount up 16% YoY at $580,470 and Vancouver’s up 13% YoY at $691,780.

Chart 2: YoY Average New Mortgage Amounts – Q3 2021

As home prices remained high, affordability continued to be a concern for consumers. In TransUnion’s latest Consumer Pulse study, 44% of respondents stated high home values were a barrier to homeownership, along with not having enough for a down payment (42%) and the lack of stable employment (30%).

Fabian concluded: “Although full recovery from the impact of COVID-19 is not over, Canada has proven its ability to adapt and operate in what is now the new normal. As economic activity increases, lenders need to be prepared to re-engage with consumers, while at the same time preparing for uncertainties of the future. Embracing the next phase of recovery will require a recalibrated approach on underwriting, advanced analytics to target resilient consumers and potential investments into effective digital channels to drive sustainable growth in acquisition and share of the consumer wallet.”

About TransUnion (NYSE: TRU)

TransUnion is a global information and insights company that makes trust possible in the modern economy. We do this by providing an actionable picture of each person so they can be reliably represented in the marketplace. As a result, businesses and consumers can transact with confidence and achieve great things. We call this Information for Good.® TransUnion provides solutions that help create economic opportunity, great experiences and personal empowerment for hundreds of millions of people in more than 30 countries. Our customers in Canada comprise some of the nation’s largest banks and card issuers, and TransUnion is a major credit reporting, fraud, and analytics solutions provider across the finance, retail, telecommunications, utilities, government and insurance sectors.

For more information or to request an interview, contact:

Contact Fiona Bang

E-mail Fiona.Bang@ketchum.com

Telephone 647-680-2885

[1] TransUnion CreditVision® score risk tier segment definitions: subprime = 300-639; near prime = 640-719; prime = 720-759; prime plus = 760-799; super prime = 800+